philadelphia wage tax return

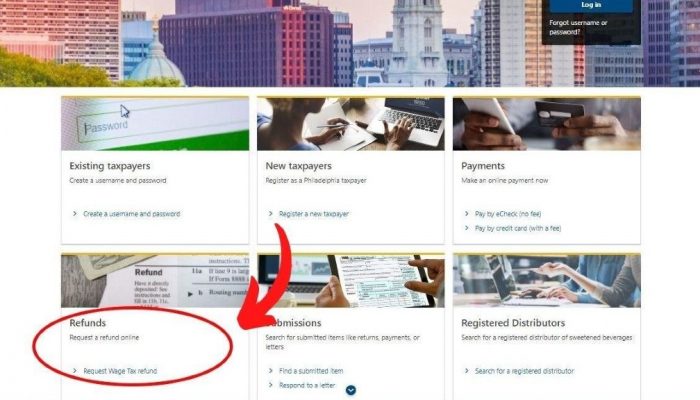

9 rows Salaried employees can use these forms to apply for a refund on Wage Tax. Starting in November 2021 Wage Tax refund requests must be submitted through the Philadelphia Tax Center.

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Pay Outstanding Tax Balances.

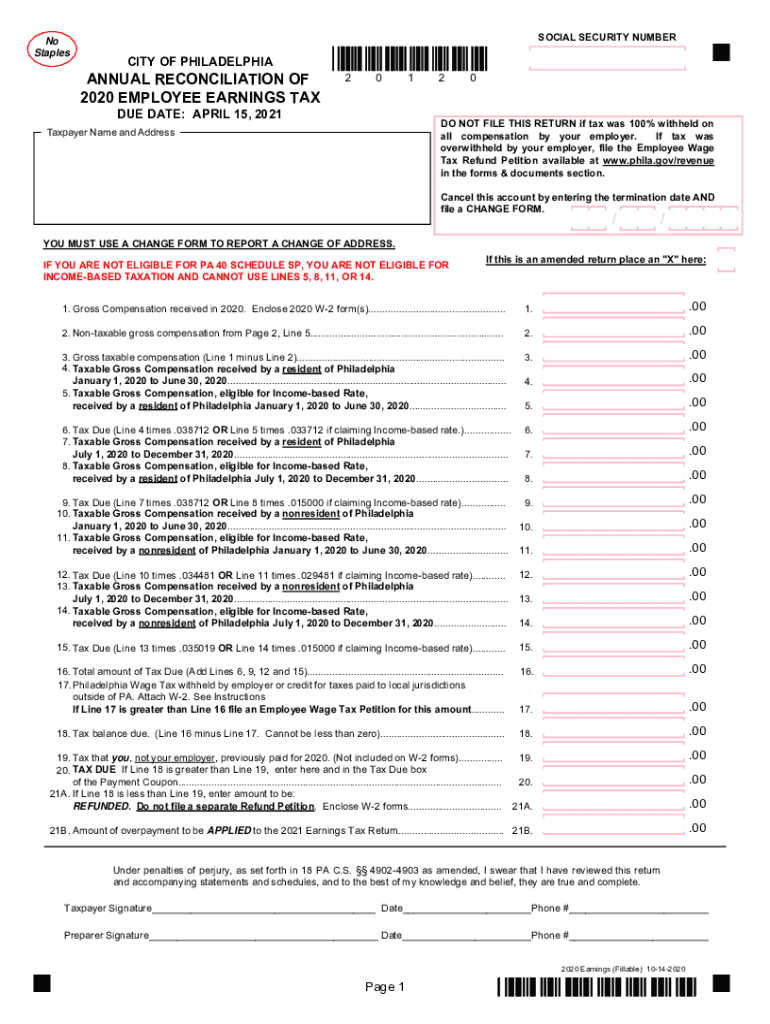

. Electronic funds transfer EFT Modernized e-Filing MeF for City taxes. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. Do not remit tax due if less than 1.

Every individual partnership association and corporation doing business in Philadelphia must file a Business Income and Receipts Tax Return in whether or not they earned a profit during the preceding year. The tax applies to payments that a person receives from an employer in return for work or services. Non-residents who work in Philadelphia must also pay the Wage Tax.

When no Wage Tax is deducted from an employees paycheck Philadelphia residents are responsible for filing and paying the Earnings Tax. All Philadelphia residents owe the City Wage Tax regardless of where they work. Also known as the Wage Tax it is typically withheld and remitted by employers with nexus in Philadelphia and employees working for employers who withhold and remit 100 of.

You dont need a username and password to request a refund on the Philadelphia Tax Center. 2022 Wage Tax forms. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

It is possible that residents of Philadelphia who are working out-of-state will be compelled to file and pay a municipal income tax in their place of employment in addition to. Instructions for filing an annual reconciliation for 2021 Wage. But this years refunds still account for much more money than in years past due to the pandemic.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. If you do not file a Wage Refund petition. You can also file and pay Wage Tax online.

April 1 2022 in Client News Alerts Tax by Adrienne Straccione. A 245 user fee will be added to the amount due when paying by credit card. Earnings Tax employees Due date.

Tax Due - If the tax due on Line 13 of the Annual Reconciliation of Wage Tax return is 1 or more make a check payable to City of Philadelphia. The nine months of taxes are not really going to New Jersey. The tax still went to Philly.

Use this form to file your 2021 Wage Tax. Tax forms instructions. To qualify your income must be subject to both the New Jersey income tax and the income or wage tax imposed by another jurisdiction outside of New Jersey for the same year.

Tax rate for nonresidents who work in Philadelphia. How to file and pay City taxes. The tax has often been cited as a job killer but it raises so much money that the city cant easily replace it.

The Employee Earnings Tax is a tax on salaries wages commissions and other compensation paid to an individual who works or lives in Philadelphia. The City Wage Tax is a tax on salaries wages commissions and other compensation. Pay delinquent tax balances.

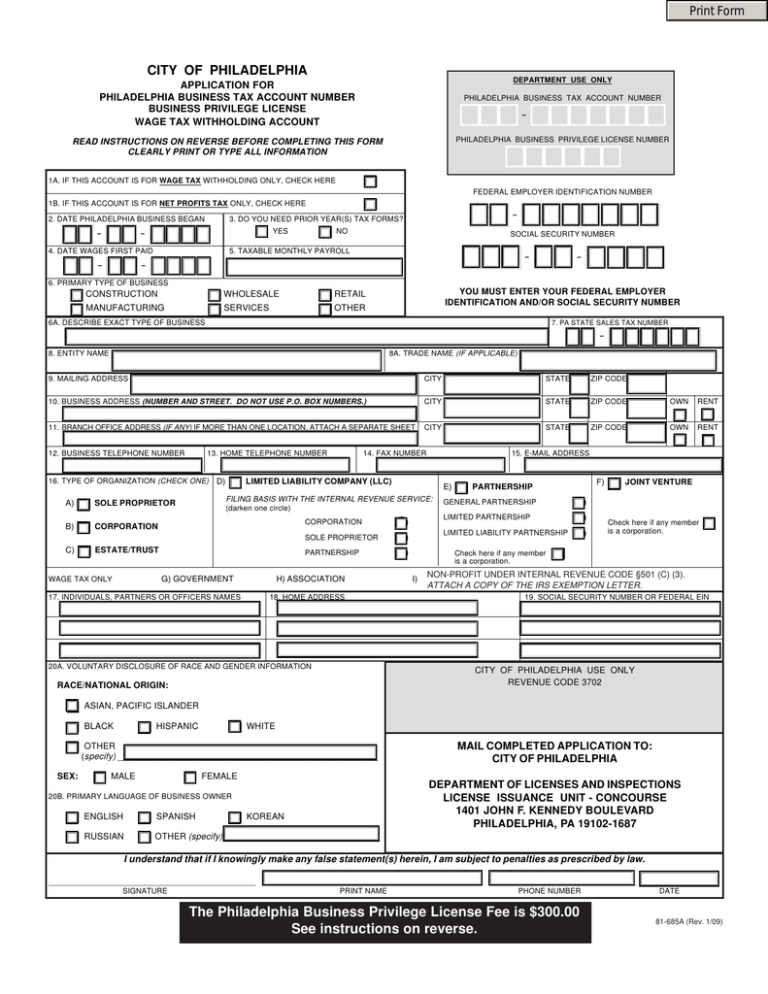

An Activity License is required for all businesses and non-profits. The Earnings Tax and the Wage Tax refer to the same tax and an employer with nexus in Philadelphia will normally withhold and remit the Philadelphia Wage Tax on its employees. Wage Tax refunds.

Out-of-state employers arent required to withhold this tax thus the employee will need to file the Employee Earnings Tax Return to ensure the tax is paid on their wages earned within the city. There will be a user fee of 595 when paying by VISA Debit Card or MasterCard Debit Card. The 105 million that Philadelphia expects to repay nonresidents represents just 62 of the 159 billion in wage tax revenue the city collected in the last fiscal year.

These are the main income taxes. Make an appointment for City taxes or a water bill in person. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents.

Non-residents who work in Philadelphia must also pay the Wage Tax. You can claim a tax credit pro-rated dollar for dollar for Philadelphia City wage taxes paidwithheld appearing on your W-2 box 19 and 20. Employer is unable due to insufficientfunds to withhold the Wage Tax on any compensation ie.

If you dont you can claim credit on the NJ return for all your Philadelphia wage tax. Philadelphia Employee Earnings Tax Return. For specific deadlines see important dates below.

Do I have to file a Philadelphia wage tax return. You can also use our online refund forms for faster and more secure processing. Before COVID-19 companies withheld Philadelphia wage tax from paychecks automatically.

Rental activities are usually considered business activities. NJ is just giving you credit for tax paid twice on the same income. The City of Brotherly Love will be happy.

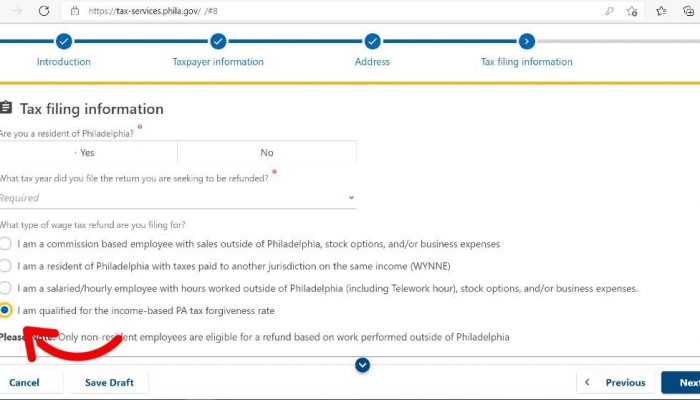

Only non-resident employees are eligible for a refund based on work performed outside. For residents and 34481 for non-residents. Any claim for refund must be filed within three years from the date the tax was paid or due whichever date is later.

The city has approved about 32000 applications for 2020 thus far Lessard said compared with. 20 rows Semi-monthly and weekly filers must submit their remaining 2021 Wage Tax returns and payments. Tax due on these returns or bill can be paid with a credit card or E-Check.

Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city. Interest penalties and fees. 2021 Wage Tax forms.

You will need to file Schedule A and B on. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly. Quarterly plus an annual reconciliation.

The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022. This includes all income-based and Covid-EZ non-residents only refunds. The deadline is weekly monthly semi-monthly or quarterly depending on the amount of Wage Tax.

The Department of Revenue has provided important reminders regarding the new. All Philadelphia residents owe the Wage Tax regardless of where they work. E-check payments are free of charge.

Philadelphia City Income Taxes to Know. Both salary and tips report those amounts here. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center.

These forms help taxpayers file 2021 Wage Tax.

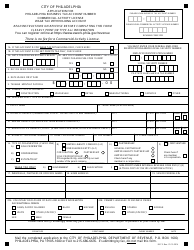

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

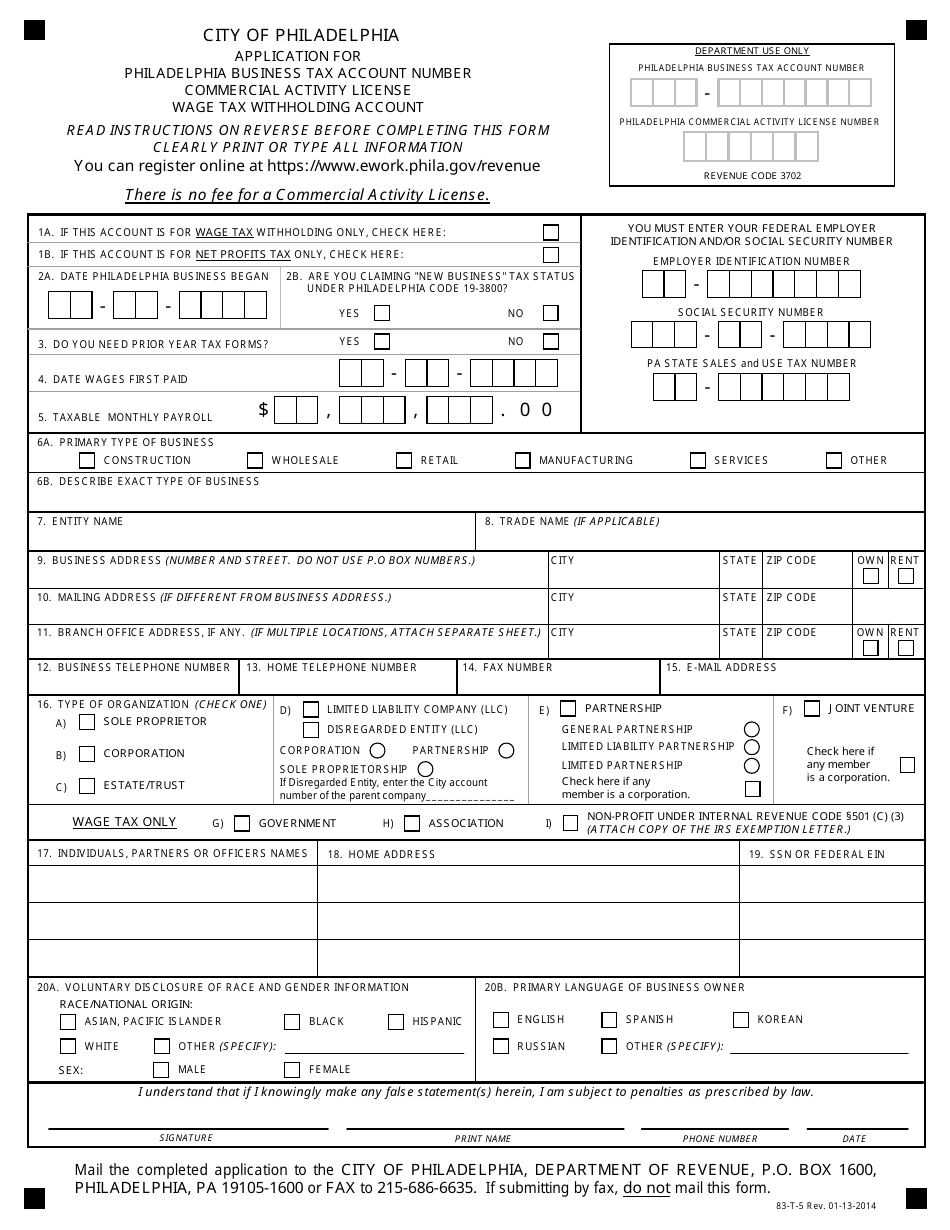

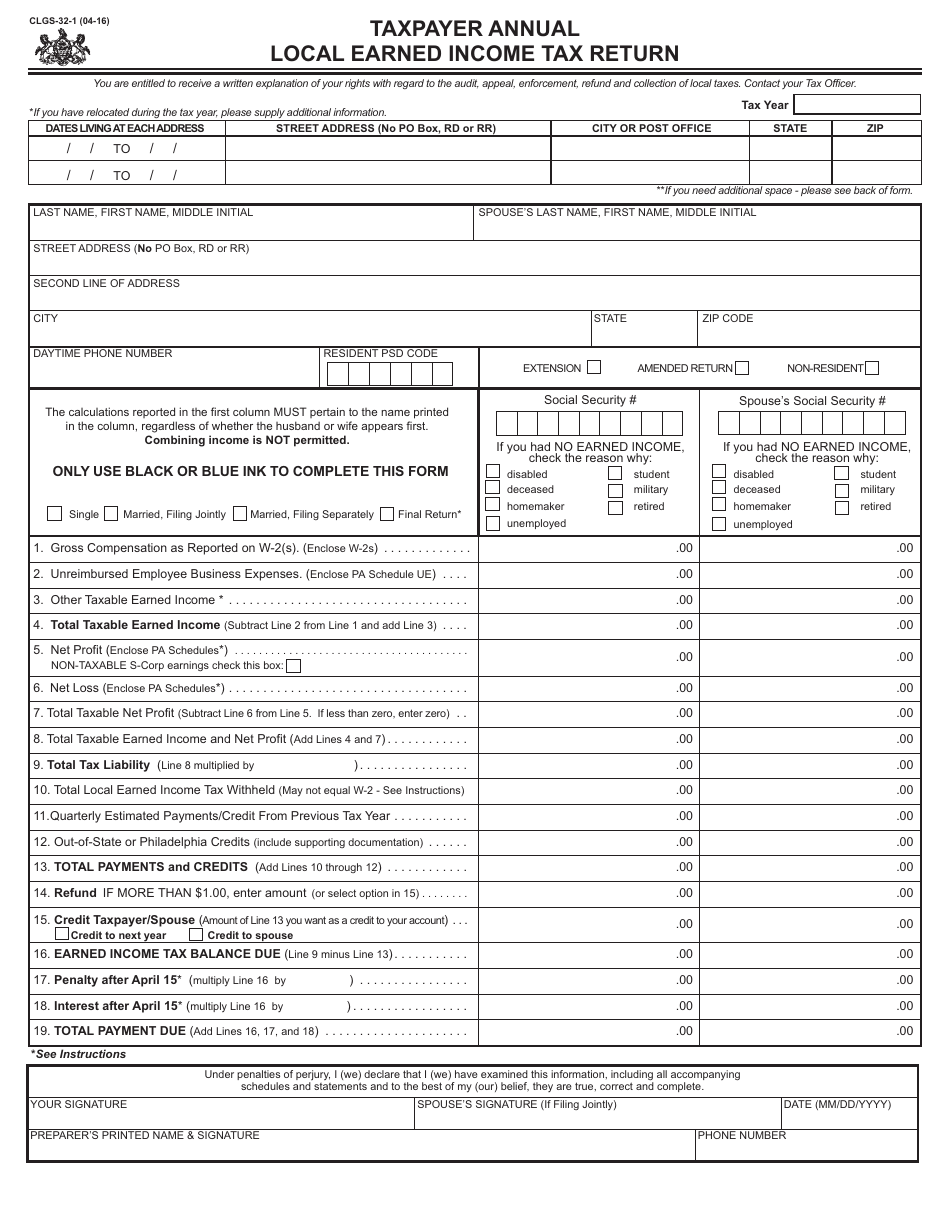

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

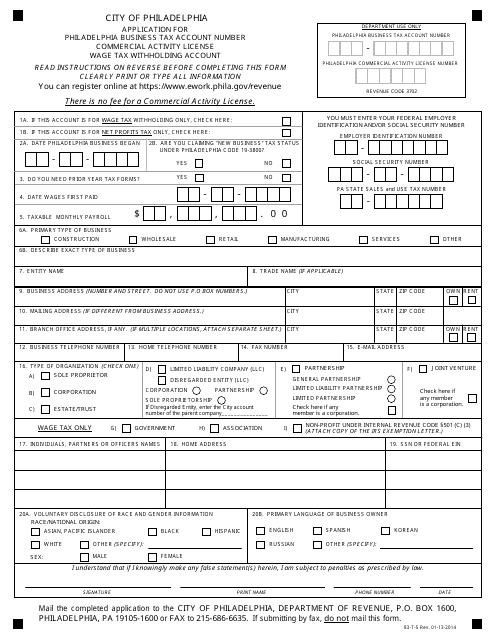

Form Clgs 32 1 Download Fillable Pdf Or Fill Online Taxpayer Annual Local Earned Income Tax Return Pennsylvania Templateroller

Pa Dced Clgs 32 1 2016 2022 Fill Out Tax Template Online Us Legal Forms

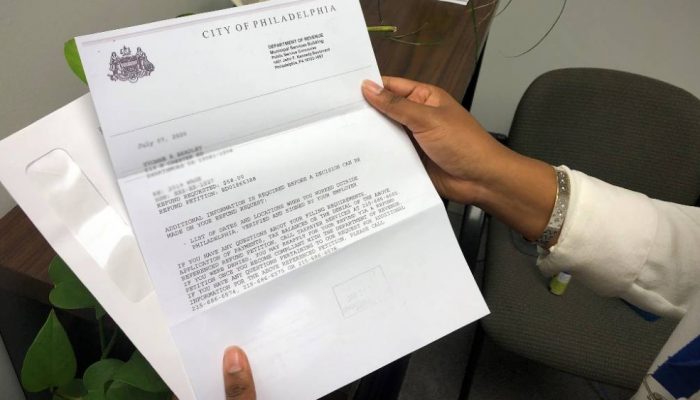

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Irs Tax Forms What Is Form W 2 Wage And Tax Statement Marca

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Amending Tax Returns With The Irs Electronic Filing Now Available For 2019

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

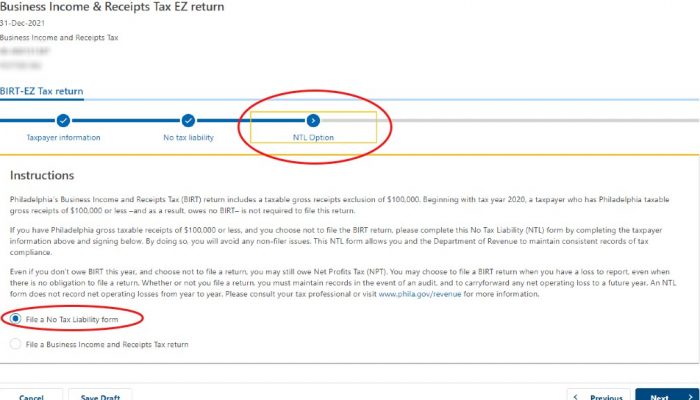

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Form 83 T 5 Download Printable Pdf Or Fill Online Application For Philadelphia Business Tax Account Number Commercial Activity License Wage Tax Withholding Account City Of Philadelphia Pennsylvania Templateroller

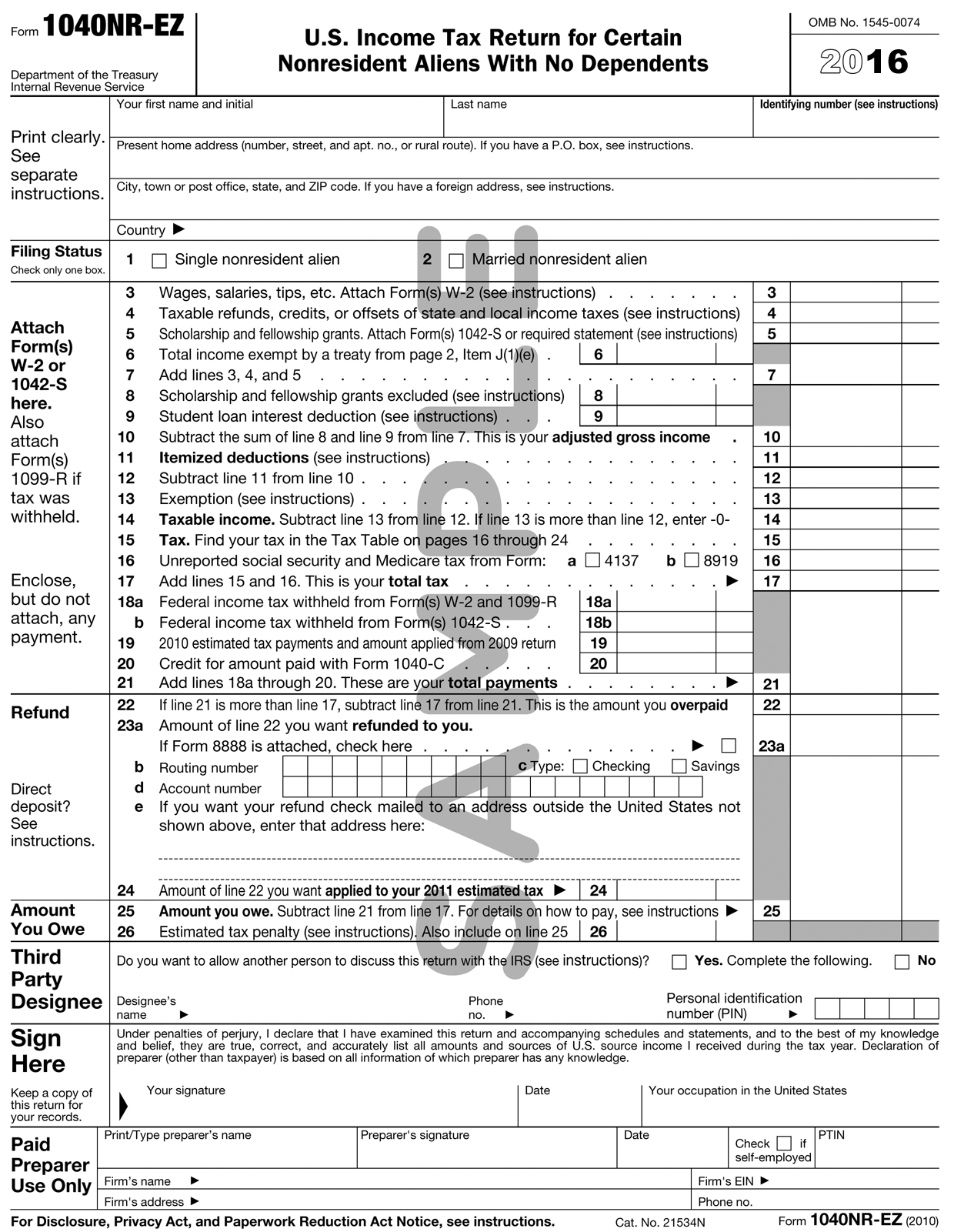

Important Tax Information And Tax Forms Camp Usa Interexchange

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia